idaho state income tax capital gains

The land in Utah cost 450000. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

The General Car Insurance Review 2022 In 2022 Car Insurance Insurance Best Car Insurance

The land in Idaho originally cost 550000.

. Idaho axes capital gains as income. Therefore the taxpayers Idaho capital gains deduction is limited to the capital gain net income included in taxable income of two thousand five hundred dollars 2500 not sixty. Idaho State Income Tax Forms for Tax Year 2021 Jan.

Taxes capital gains as income and the rate reaches 66. Capital gains are taxed as ordinary income in Idaho. IDAPA 35 IDAHO STATE TAX COMMISSION Tax Policy Taxpayer Resources Unit 350101 Income Tax Administrative Rules.

Section 63-3039 Idaho Code Rules and. Taxes capital gains as income and the rate reaches 575. Learn about Hawaii tax rates for income property sales tax and more to estimate what you owe for the 2021 tax year.

Statement of Purpose Fiscal Impact. Inheritance and Estate Tax and Inheritance and. Look up 2021 Idaho sales tax rates in an easy to navigate table listed by county and.

Mary must report 55000 of Idaho source income from the gain on the sale of the land computed. The 2022 state personal income tax brackets are. In Idaho property taxes are set at the county level.

The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital. Hawaii state income tax rates range from 14 to 11. Arizona capital gains tax rate 2021.

Toggle navigation 2022 Federal Tax Brackets. Download or print the 2021 Idaho Idaho Capital Gains Deduction 2021 and other income tax forms from the Idaho State Tax Commission. Arizona capital gains tax rate 2021.

Idaho State Income Tax Forms for Tax Year 2021 Jan. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income. Taxes capital gains as income and the rate reaches 66.

Before the official 2022 Idaho income tax rates are released provisional 2022 tax rates are based on Idahos 2021 income tax brackets. STATEMENT OF PURPOSE RS 11318 This bill will extend the Idaho capital gains deduction to corporations engaged in agriculture timber or mining. 2021 federal capital gains tax rates.

Additional State Capital Gains Tax Information for Idaho. CG - Idaho State Tax Capital Gains Deduction. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income.

In Idaho the uppermost. Idaho axes capital gains as income. In Idaho property taxes are set at the county level.

Who Is Exempt From Paying Capital Gains Tax

York Maine States Preparedness

Taxes Fees Montana Department Of Revenue

State Corporate Income Tax Rates And Brackets Tax Foundation

A Guide To The Fair Housing Act And Its Exemptions Forbes Advisor

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Council Post Show Me The Money Real Estate Revenue In The Modern Age Of Home Flippers Real Estate Investor Real Estate Trends Show Me The Money

Five Tax Tips For Community Property States Turbotax Tax Tips Videos

Financial Times 12 12 16 Los Altos Hills Turks And Caicos Islands Chamonix

Form 8832 Instructions A Simple Guide For 2022 Forbes Advisor

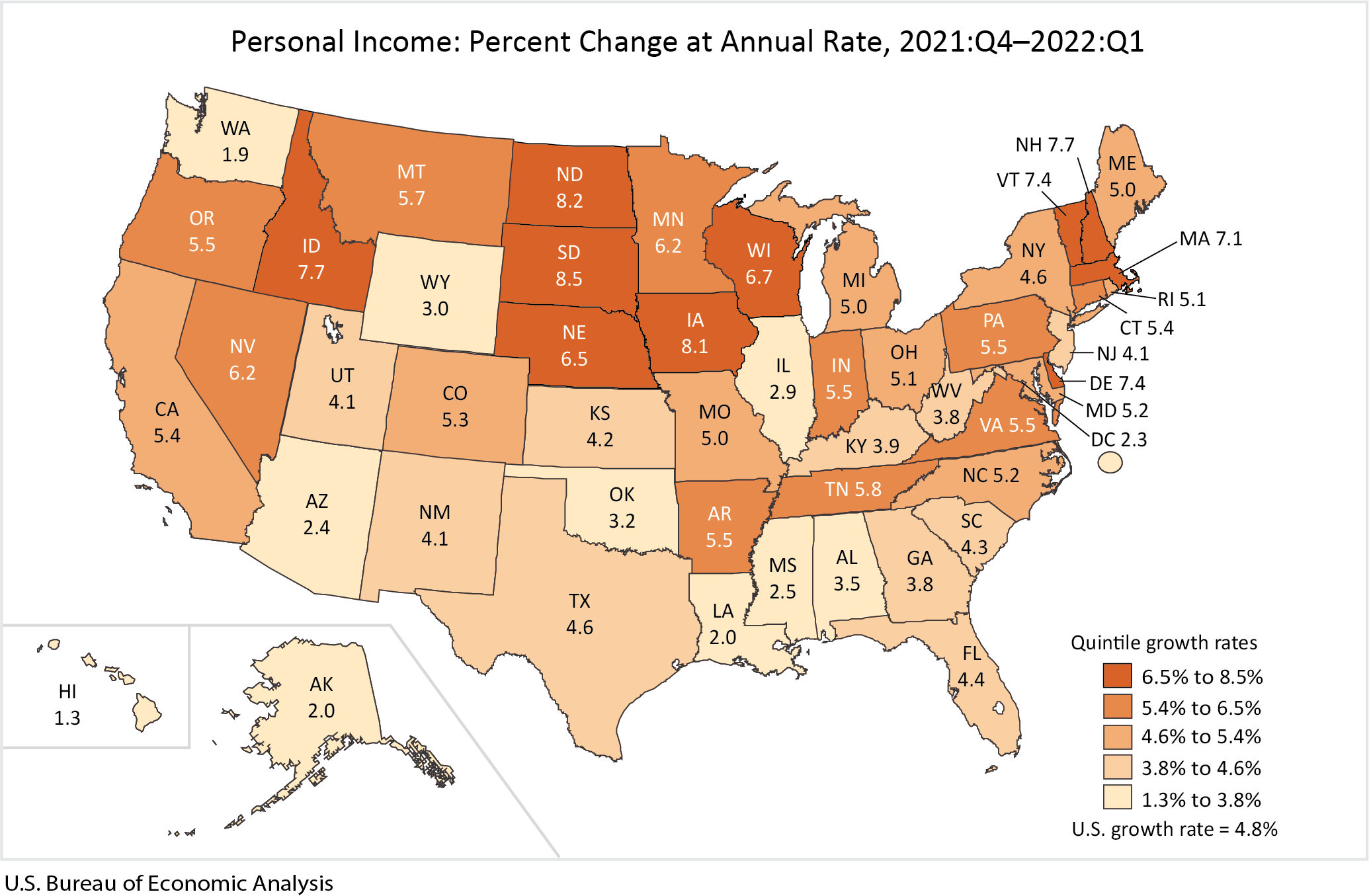

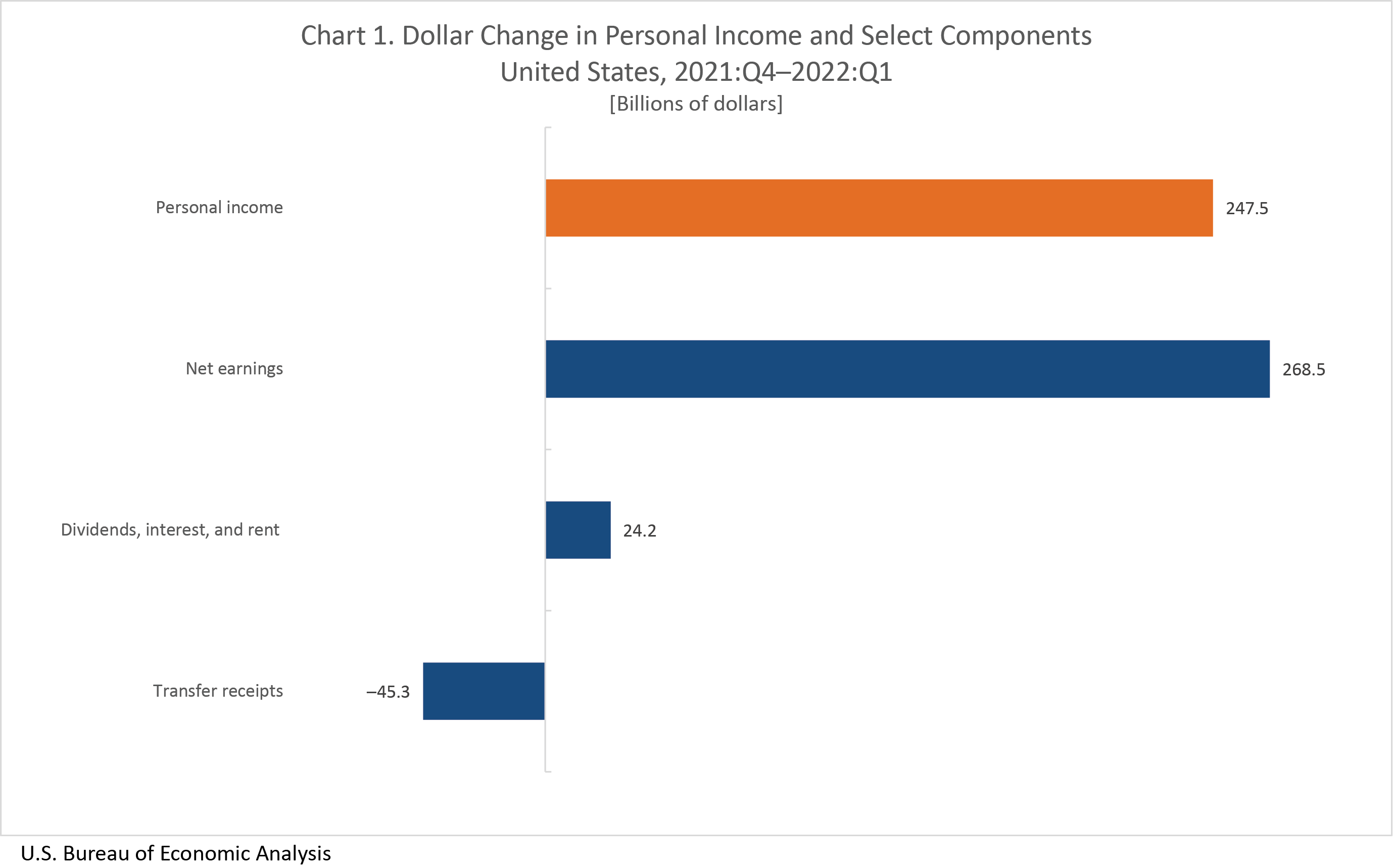

Personal Income By State 1st Quarter 2022 U S Bureau Of Economic Analysis Bea

Personal Income By State 1st Quarter 2022 U S Bureau Of Economic Analysis Bea

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Avoid Capital Gains Tax On The Sale Of Qualified Small Business Stock Legalzoom Com

Capital Gains Tax Idaho Can You Avoid It Selling A Home

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service